Uber car depreciation calculator

The calculator also estimates the first year and the total vehicle depreciation. The Standard Mileage deduction allows you to deduct.

A New Car Is Purchased For 38 000 And Over Time Its Value Depreciates By One Half Every 4 5 Years How Long To The Nearest Tenth Of A Year Would It Take For

The vehicle was purchased for 22000 privately so unable to claim GST.

. Dacia 25 average 3 year depreciation. Gas repairs oil insurance registration and of course. Car Depreciation Calculator Currency.

The GST on the car is 1800 and you will get 60 of that back on your BAS being 1080. Eligible tax deductions for Uber drivers in Australia include. Its based on a sliding scale of 25.

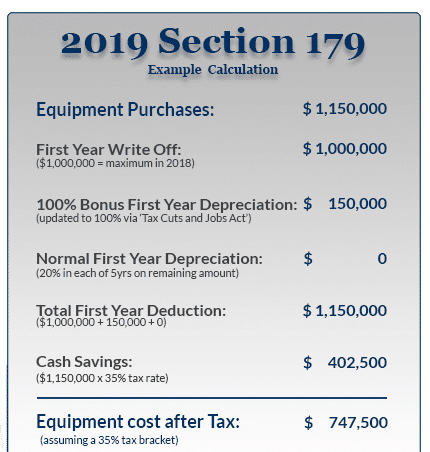

Equal expensing each year so if you spent 30000 on your car on January 1st divided evenly over 5 years you would get a 6000 deduction per year. Tax Deduction for Car against Uber profits 5000 x 21 tax rate and 11000 x 0 tax rate 1050 actual tax benefit. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

Depreciation of most cars based on ATO estimates of useful life is. When filing taxes you have a choice between two deduction methods. It is fairly simple to use.

Based on my research the consensus seems to be that new cars depreciate an average of 24 in the first year and 15 in the remaining years. 100 Strategy Tools Book By FourWeekMBA. The car depreciation formula for this method is.

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Vehicle expenses including deprecation car lease payments or loan interest Fuel expenses. 100 Business Models Book By FourWeekMBA.

You buy a car for 19800 and you will use that car 60 for Uber. All you need to do is. For instance a widget-making machine is said to depreciate.

My tax accountant was only able to claim 2900 for depreciation. Chrysler 50 average 3 year depreciation. Citroen 45 average 3 year depreciation.

For this driver the first 5000 of their car tax deduction. Get 30 days of Kover for Free Get Paid Time Off Sick Leave for Uber Lyft Drivers gig workers plus a lawyer to get your account reactivated. We will even custom tailor the results based upon just a few of.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Standard Mileage or Actual Expenses not both. Chevrolet 55 average 3 year depreciation.

Select the currency from the drop-down list optional Enter the. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Note that this method.

Car Depreciation Rate And Idv Calculator Mintwise

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator

How To Calculate Uber Car Depreciation And Instant Write Off My Uber Income

How To Calculate Your Car Depreciation Youtube

10 Expenses You Can Claim As An Uber Car Driver Universal Taxation

Car Depreciation Is Negligible When You Are Driving For Uber Youtube

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

How To Calculate Depreciation On A Car Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture

How To Drive For Uber Credit Karma

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Do Uber Eats Uber Pay For Gas Ultimate 2022 Guide For Drivers

The Real Costs Of Driving For Uber And Lyft 2022 Update

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Managing The Hidden Costs Of Car Depreciation Nerdwallet

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos